- #Commercial venture definition real estate software#

- #Commercial venture definition real estate mac#

The website owner is not responsible for damages allegedly arising from use of this website's AI.Ĭopyright © 2023 Janover Inc. Users should not rely upon AI-generated content for definitive advice and instead should confirm facts or consult professionals regarding any personal, legal, financial or other matters. This website utilizes artificial intelligence technologies to auto-generate responses, which have limitations in accuracy and appropriateness.

#Commercial venture definition real estate mac#

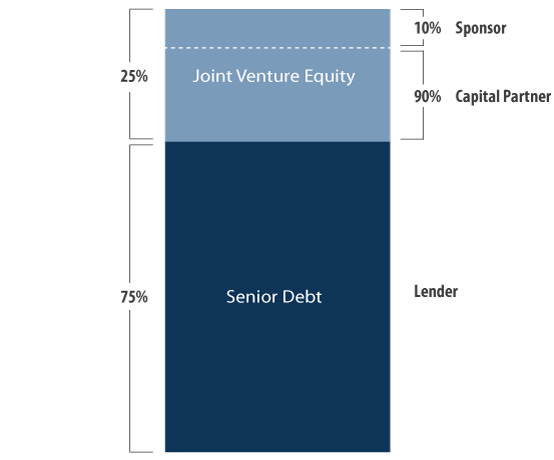

We are not affiliated with the Department of Housing and Urban Development (HUD), Federal Housing Administration (FHA), Freddie Mac or Fannie Mae. Commercial real estate differs from residential real estate because it has the. Between the capital requirements, the industry-specific jargon, and the sheer scale, the barriers to. In almost any other form of alternative investment, a sponsor promote is referred to as carried interest. This term is really just industry jargon for the sponsor’s disproportionate share of profits in a real estate deal above a predetermined return threshold. Fannie Mae® is a registered trademark of Fannie Mae. Commercial real estate refers to properties used specifically for business or income-generating purposes. Investing in commercial real estate can seem daunting. A key term to a real estate private equity deal is the sponsor promote. We use cookies to provide you with a great experience and to help our website run effectively.įreddie Mac® and Optigo® are registered trademarks of Freddie Mac. By using this website, you agree to our use of cookies, our Terms of Use and our Privacy Policy.

#Commercial venture definition real estate software#

We are a technology company that uses software and experience to bring lenders and borrowers together. A real estate fund is a type of mutual fund that invests in. We have no affiliation with any government agency and are not a lender. A real estate investment trust (REIT) is a corporation that invests in income-producing real estate and is bought and sold like a stock. This website is owned by a company that offers business advice, information and other services related to multifamily, commercial real estate, and business financing. This means that no one creditor or investor should be given preferential treatment, and that all creditors or investors should receive the same amount of money, regardless of the amount of money they invested.

:max_bytes(150000):strip_icc()/Venturecapital-2f7ba3a27d0545f682a6238ea6b16cb9.png)

The legal implications of pari passu in commercial real estate are that all creditors or investors must be treated equally and fairly. This is important to ensure that all investors are treated fairly and that no one investor is given preferential treatment. They’re typically about 0.5 to 1 higher than the 30-year prime rate for mortgages. In addition, pari passu is also used to ensure that all investors in the same class receive the same amount of money, regardless of the amount of money they invested. Interest rates on commercial real estate loans tend to be higher than those for residential loans. This is important to ensure that all creditors or investors are treated fairly and that no one creditor or investor is given preferential treatment. This means that if a borrower defaults, all creditors or investors will have an equal right to the borrower’s assets. As its name implies, commercial real estate is used in commerce, and multiunit rental properties that serve as residences for tenants are classified as commercial activity for the landlord.In commercial real estate, pari passu is used to ensure that all creditors or investors have an equal claim on a borrower’s assets, especially in the case of a borrower default. Residential properties include structures reserved for human habitation and not for commercial or industrial use.

Understanding Commercial Real Estate (CRE)Ĭommercial real estate and residential real estate comprise the two primary categories of real estate property. Publicly traded real estate investment trusts (REITs) are a feasible way for individuals to indirectly invest in commercial real estate.Commercial real estate provides rental income as well as the potential for some capital appreciation for investors.The four main classes of commercial real estate are office space, industrial, multifamily rentals, and retail.This type of financing allows the user to meet current. Immune to Inflation: When economic inflation creates a negative impact on the value of other investments, investing in real estate is a fruitful option. Commercial real estate differs from residential real estate because it has the potential to generate profit for the property owner through capital gain or rental income. Bridge Loan: A bridge loan is a short-term loan used until a person or company secures permanent financing or removes an existing obligation. Tangible: Real estate or properties are one of those investments which have a physical existence and can be touched and seen.Commercial real estate refers to properties used specifically for business or income-generating purposes.

0 kommentar(er)

0 kommentar(er)